Operational AI that ships in weeks, not months.

Aligned to Kenya’s AI Strategy; secure pilots, clean data pipelines, and measurable outcomes.

Trusted by teams in Banking, Insurance & Pharma

We help regulated organizations ship production AI—securely, responsibly, and with clear ROI.

About Ingubu Kenya

We’re an AI R&D+i studio helping banks, insurers, and Pharmaceuticals in Kenya ship production-ready solutions rapidly.

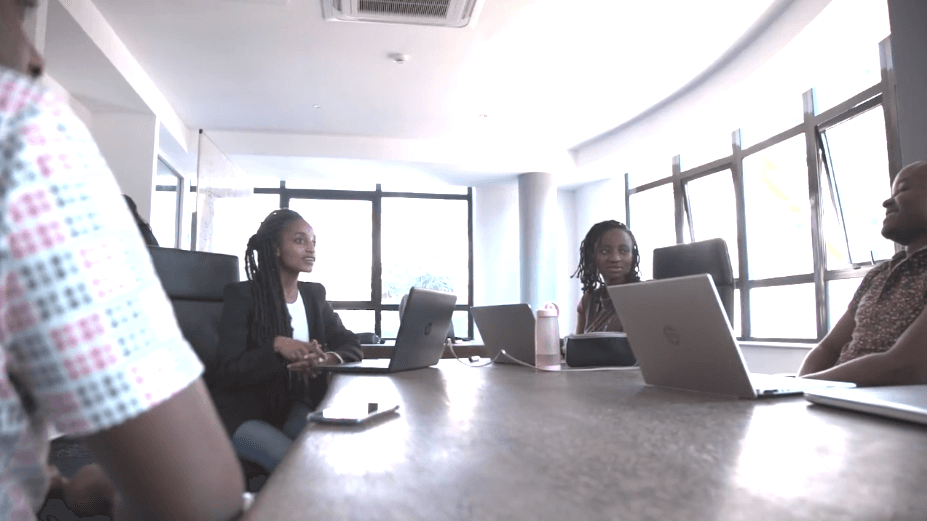

Building AI that ships, not slides

Ingubu Kenya blends product strategy and data engineering to deliver real outcomes for businesses and institutions.

We’re local-first, privacy-aware, and obsessed with measurable ROI — from automation flows, to supporting frontline teams with decision-ready insights.

Built by practitioners

20+ years of combined experience in ICT, innovation, and AI R&D.

Local First Approach

Deep experience with providing tailored market solutions for real-world problems.

From pilot to playbook

Instrumented pilots, clear KPIs, and handover with training and docs so your teams can scale confidently.

2016–2020: Foundations

Industrial predictive maintenance & AR (TensorFlow, LSTM).

AI for L&D: Job–Skill–Course matching (embeddings, ESCO, xAPI).

Early LLM's-3 → knowledge graphs & copywriting assistants.

2021–2023: Sector Builds

Healthcare & pharma R&D (deep learning, XAI for patient–treatment–drug).

ESG analytics: news & sentiment, credibility scoring, vector DB.

Clustering, risk & security tooling; vendor-neutral MLOps.

2024 → Now: Agents & Pilots

Claims, clinical copilots, and graph Q&A with LLMs.

4–6-week ROI pilots across banking, insurance, and pharma.

LLMOps, data-minimized workflows, and production copilots.

Our Services

Practical, production-grade AI for banks, insurers, and pharma—built for real customers and regulated workflows.

Banking & Fintech

Real-time fraud & risk, thin-file credit scoring, and growth analytics—built for local compliance and auditability.

See moreInsurance

Claims automation with Document AI, explainable underwriting, and policy copilots—EN/SW—built for compliance.

See morePharma

Pharmacovigilance intake, medical affairs copilots, and regulatory evidence packs—traceable and audit-ready.

See more

How We Integrate AI Into Your Systems

Fast, secure, and measurable.

1) Connect

Secure APIs to your core apps.

2) Orchestrate

Wire AI into your workflows.

3) Launch

Go live with SLAs & metrics.

Why teams stay with Ingubu Kenya

Practical AI that fits your stack, your data, and your governance—delivered quickly and safely.

Kenya-ready

Built for local compliance, data protection, and stakeholder workflows.

Fast to value

4–6 week pilots with clear KPIs—prove ROI before you scale.

Secure & compliant

Your cloud or on-prem. RBAC, audit logs, and policy-aligned controls.

End-to-end delivery

Strategy → Data → Models → MLOps → Training. We ship to prod.

Launch an AI Pilot in 30–60 Days

Aligned to the national strategy—governance, evaluation, and KPI dashboards from day one. Book a demo to get a clear plan.

Frequently Asked Questions

Quick answers about pilots, integrations, timelines and pricing. If you don’t see your question, contact us.

Ingubu Kenya designs and ships production-grade AI for regulated teams—banking, insurance, and pharma—so value shows up in day-to-day work. We prioritize reliability, explainability, and clean UX.

Banks, fintechs, insurers, and pharmaceutical organizations. From early-stage to enterprise, we tailor scope so you can test, learn, and scale with confidence.

We map KPIs, check data, and design the pilot—then build the workflow: data prep, models, guardrails, and UI. Most pilots run 4–6 weeks with dashboards and training ready before a controlled go-live.

Your cloud or on-prem—never ours. We sign DPAs, apply least-privilege access, and log every touchpoint. No dataset leaves your environment without written approval.

Pilots use fixed-fee sprints to keep scope clear and risk low. For production, we switch to a subscription with support and cost tuning. You get milestone plans, acceptance tests, and transparent reporting.